http://elpais.com

スペインの金融資本の国外流出が増加、2012年03月には、合計662億0000'0000ユーロの資本国外流出、資本摘出;460億0000'0000ユーロ(スペイン人投資家の外国への避難投資が261億6400万0000ユーロ+外国人投資家の資本摘出が202億4800万0000ユーロ)+外国人投資家の株式や国債からの撤退が226億3300万0000ユーロ、2011年07月から2012年03月までの資本流出は、1940億0000'0000ユーロに昇る

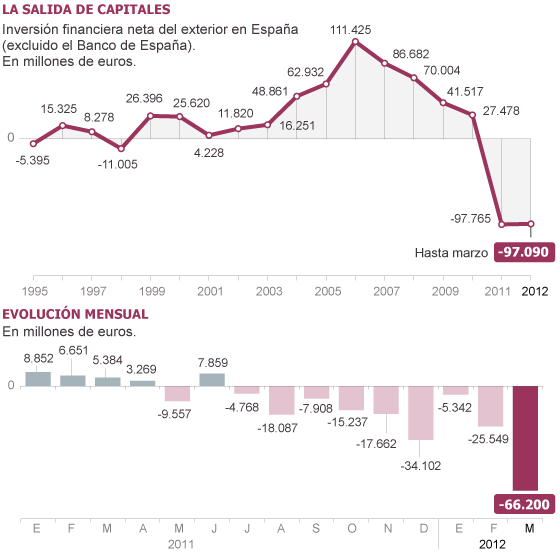

La salida de capitales de la economía española sobrepasa todos los récords

La retirada de fondos llegó en marzo a 66.200 millones, casi el doble que el anterior máximo

Casi un tercio del saldo se debe a la liquidez que colocan bancos españoles en el exterior

En nueve meses, han salido 200.000 millones en recursos financieros de la economía española

El dinero que salió de bonos y acciones españoles multiplica por diez los datos de hace un año

Archivado en:

- Crisis económica

- Recesión económica

- Capitales extranjeros

- Coyuntura económica

- Crisis financiera

- Moneda

- España

- Finanzas

- Economía

Fuente: Banco de España y Tesoro Público. / El País

The outflow of capital of the Spanish economy surpasses all records

The withdrawal came in March to 66,200 million, nearly double the previous maximum

Almost a third of the balance is due to liquidity put Spanish banks abroad

In nine months, have left 200,000 million in financial resources of the Spanish economy

The money came from Spanish stock and bond data ten times a year ago

The external deficit down almost 12% in first quarter

Alejandro Bolaños Madrid 31 MAY 2012 - 12:27 CET

The withdrawal came in March to 66,200 million, nearly double the previous maximum

Almost a third of the balance is due to liquidity put Spanish banks abroad

In nine months, have left 200,000 million in financial resources of the Spanish economy

The money came from Spanish stock and bond data ten times a year ago

The external deficit down almost 12% in first quarter

Alejandro Bolaños Madrid 31 MAY 2012 - 12:27 CET

The risk premium on government debt is the main indicator of distrust in Spain. But there are other, equally or more critical to an open economy that shed a very negative readings. According to data just released by the Bank of Spain, the outflow of financial capital of the Spanish economy in record-breaking March. Between what international investors withdrew and what Spanish investors placed on the outside left 66 200 million, almost double last December, the month that marked the ceiling yet. More than a third of that deficit is due to Spanish money that has gone to foreign deposits and loans, a move that has accelerated dramatically and that corresponds, the vast majority of Spanish banks with operations.

In all the statistical series, the Bank of Spain began in 1990, not recorded a capital outflow of these dimensions. Are linked and nine months of negative balances in net financial investment from abroad, a gap which has been lost and 194,000 million since last July, half (97,000 million) in the first three months of this year. And what happened to the Spanish stock market in April and May, where sales have been imposed by a landslide to shopping, supports the idea that the current trend continues. Other statistics, more recent, are in the same direction: in April, the government debt held by international investors barely reached 37%. Also that month, the bank lost almost 2% of deposits of businesses and households, the second largest drop was the euro.

Spanish investments in deposits and foreign loans has accelerated

In March bulging deficit weighs on all developments at the Bank of Spain called other investments, a group that includes loans and deposits. Here the withdrawal of capital is of more than 46,000 million, and should be even greater extent to which Spanish investors have placed on the outside (26,164,000), that what foreign investors have withdrawn Spanish assets (20,248,000). Both are record numbers, but more striking is the Spanish capital flight abroad, with an intensity much higher than previous months.

The explanation of this movement so intense lies almost entirely in the interbank market decisions. Spanish banks placed 19.704 million in deposits and repos hedging with foreign banks. It is, again, unprecedented, which responds to the need to place liquidity (after two injections multimillion European Central Bank). And also, a sign of mistrust in the Spanish interbank, which is also seen in the gradual withdrawal of foreign entities. The Spanish government also placed a significant amount of money in such investments abroad, nearly 5,000 million. Not for companies and families, where financial outflows stood at amplitudes (1.477 million in March) less relevant in the statistical series.

In portfolio investments, including stocks and bonds, the negative balance is due almost exclusively to foreign investors. Here the withdrawal of international capital (22,633,000) is brutal, almost double the previous monthly highs, and ten times more than in March 2011, as well as the contributions were reflected in the financial markets. Finally, direct investment of foreign companies in Spain has a positive, albeit moderate, barely 2,800 million.

In all the statistical series, the Bank of Spain began in 1990, not recorded a capital outflow of these dimensions. Are linked and nine months of negative balances in net financial investment from abroad, a gap which has been lost and 194,000 million since last July, half (97,000 million) in the first three months of this year. And what happened to the Spanish stock market in April and May, where sales have been imposed by a landslide to shopping, supports the idea that the current trend continues. Other statistics, more recent, are in the same direction: in April, the government debt held by international investors barely reached 37%. Also that month, the bank lost almost 2% of deposits of businesses and households, the second largest drop was the euro.

Spanish investments in deposits and foreign loans has accelerated

In March bulging deficit weighs on all developments at the Bank of Spain called other investments, a group that includes loans and deposits. Here the withdrawal of capital is of more than 46,000 million, and should be even greater extent to which Spanish investors have placed on the outside (26,164,000), that what foreign investors have withdrawn Spanish assets (20,248,000). Both are record numbers, but more striking is the Spanish capital flight abroad, with an intensity much higher than previous months.

The explanation of this movement so intense lies almost entirely in the interbank market decisions. Spanish banks placed 19.704 million in deposits and repos hedging with foreign banks. It is, again, unprecedented, which responds to the need to place liquidity (after two injections multimillion European Central Bank). And also, a sign of mistrust in the Spanish interbank, which is also seen in the gradual withdrawal of foreign entities. The Spanish government also placed a significant amount of money in such investments abroad, nearly 5,000 million. Not for companies and families, where financial outflows stood at amplitudes (1.477 million in March) less relevant in the statistical series.

In portfolio investments, including stocks and bonds, the negative balance is due almost exclusively to foreign investors. Here the withdrawal of international capital (22,633,000) is brutal, almost double the previous monthly highs, and ten times more than in March 2011, as well as the contributions were reflected in the financial markets. Finally, direct investment of foreign companies in Spain has a positive, albeit moderate, barely 2,800 million.

スペインの金融資本の国外流出が増加、2012年03月には、合計662億0000'0000ユーロの資本国外流出、資本摘出;460億0000'0000ユーロ(スペイン人投資家の外国への避難投資が261億6400万0000ユーロ+外国人投資家の資本摘出が202億4800万0000ユーロ)+外国人投資家の株式や国債からの撤退が226億3300万0000ユーロ、2011年07月から2012年03月までの資本流出は、1940億0000'0000ユーロに昇る

0 件のコメント:

コメントを投稿