http://elpais.com

信用格付け会社のMoody'sは、スペインの銀行うち、Santander,BBVA,Banesto,CaixaBank,Caja Laboral,CajaRural de Navarra,Banca March の7つの銀行に合格点を付けた

Moody’s solo salva del bono basura a siete bancos españoles

La agencia de calificación reduce entre uno y cuatro escalones la nota de 28 entidades

Santander logra quedarse por encima de la nota de solvencia de España

BBVA, Banesto, Caixabank, Caja Laboral, Caja Rural de Navarra y Banca March aprueban

Moody's junk bond only saves seven Spanish banks

The rating agency reduces one to four steps the note of 28 entities

Santander manages to stay above the credit rating of Spain

BBVA, Banesto, Caixabank, Caja Caja Rural de Navarra and approve Banca March

Read the statement from the agency (in English)

Changes in ratings by state

The Country Madrid 26 JUN 2012 - 01:34 CET

The rating agency reduces one to four steps the note of 28 entities

Santander manages to stay above the credit rating of Spain

BBVA, Banesto, Caixabank, Caja Caja Rural de Navarra and approve Banca March

Read the statement from the agency (in English)

Changes in ratings by state

The Country Madrid 26 JUN 2012 - 01:34 CET

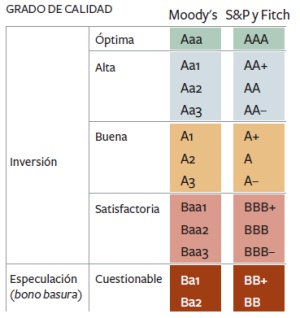

The rating agency Moody's risk has announced a cut block of Spanish banks. In a statement noted that degrades the note of 28 entities, one to four steps. The firm explains that the rating downgrade of Santander but leaves a level above the Spanish sovereign debt (which degraded the brink of junk bond, to Baa3) and the rest of the bench, "the note from Spain or below" , ie the edge of the junk bond or even longer in this dangerous area. Santander's geographical diversification value. The rest, he notes, have been dropped from one to four rating grades.

Santander gets the best rating (Baa2), okay. BBVA remains in the approved but justito, with Spanish debt at Baa3. Also in this step, the edge of the junk bond but still recommended investment consideration, Moody's leaves Banesto, Caixabank, Caja Banca March and Caja Rural de Navarra. The state lender, the Official Credit Institute (ICO) also remains afloat, the level of Spain. The other significant groups move to the next level Spanish, considered speculative investments.

A Bankinter, for example, will cut two notches from Baa2 to Ba1, the first level of junk bond. People's Bank still goes a long way: A3, remarkably, to Ba1, junk bond. Sabadell Baa1 to Ba1 passes as Kutxabank. The ECSC is also at this step, which even before this reduction were Banco Pastor or Liberbank. Cajamar, suspended in the previous review also delves more into the junk rating. Bankia, which last was still an approved rating falls now to the second level of junk bond, Ba2.

The decision by Moody's takes into account the potential impact on the Spanish banking rescue that the government has formally asked on Monday for Brussels. "The downgrade today occurs after weakening the solvency of the Spanish Government," the agency.

The degradation of the financial sector follows the trail of the reduction of three steps of the Spanish public debt of June 13, when the rating agency left the solvency of Spain to the brink of junk status. The downgrade from A3 to Baa3 with negative outlook, was justified in the "very limited" access to finance and weak economic situation.

Notes

■ Santander: A3 to Baa2

■ Banesto: A3 to Baa3

■ BBVA: A3 to Baa3

■ Caja: Baa2 to Baa3

■ Banca March: Baa1 to Baa3

■ Navarra Caja Rural: Baa1 to Baa3

■ CaixaBank: A3 to Baa3

■ ICO: A3 to Baa3

■ Bankinter: Baa2 to Ba1

■ Bank Coop: Baa1 to Ba1

■ Banco Popular: A3 to Ba1

■ Bankia: Baa3 to Ba2

■ Bank CEISS: Baa3 to B1

■ Catalonia Banc: Ba1 to B1

■ Novacaixagalicia: Ba1 to B1

Although there are six banks that are saved from the burning of Moody's to the sector (Santander, BBVA, Banesto, Caixabank, Banca March and Education Fund), have not escaped suffering a downgrade. Thus, Santander, the better off everyone and that leaves even above the solvency which gives the debt of Spain, has downgraded two notches to Baa2. BBVA subtracts one more, to Baa3. And there, on the brink of junk bond also remain Caixabank, Banca March and Education Fund. For all, sends a warning: they have a negative outlook.

This is the second time that Moody's downgrades the note to the Spanish banks quickly. Last May, the 17th, announced that collectively lowered the rating of Spanish banks and degraded one to three steps the note of 16 Spanish banks, including Banco Santander, BBVA, Banesto and CaixaBank. Still, the four were in a position conducive to investment, in the category considered almost as remarkable.

Meanwhile, Standard & Poor's left at the end of May to the middle of the Spanish financial system, consisting of 14 entities, junk bond. Downgraded the credit rating of five Spanish financial institutions, including the nationalized Bankia, Popular and Bankinter, which were below the investment grade.

More recent is the decision to downgrade the bank at Fitch. On June 11 he downgraded two BBVA and Santander degree, and one day after the rest of the block area, in some cases up to three steps.

Santander gets the best rating (Baa2), okay. BBVA remains in the approved but justito, with Spanish debt at Baa3. Also in this step, the edge of the junk bond but still recommended investment consideration, Moody's leaves Banesto, Caixabank, Caja Banca March and Caja Rural de Navarra. The state lender, the Official Credit Institute (ICO) also remains afloat, the level of Spain. The other significant groups move to the next level Spanish, considered speculative investments.

A Bankinter, for example, will cut two notches from Baa2 to Ba1, the first level of junk bond. People's Bank still goes a long way: A3, remarkably, to Ba1, junk bond. Sabadell Baa1 to Ba1 passes as Kutxabank. The ECSC is also at this step, which even before this reduction were Banco Pastor or Liberbank. Cajamar, suspended in the previous review also delves more into the junk rating. Bankia, which last was still an approved rating falls now to the second level of junk bond, Ba2.

The decision by Moody's takes into account the potential impact on the Spanish banking rescue that the government has formally asked on Monday for Brussels. "The downgrade today occurs after weakening the solvency of the Spanish Government," the agency.

The degradation of the financial sector follows the trail of the reduction of three steps of the Spanish public debt of June 13, when the rating agency left the solvency of Spain to the brink of junk status. The downgrade from A3 to Baa3 with negative outlook, was justified in the "very limited" access to finance and weak economic situation.

Notes

■ Santander: A3 to Baa2

■ Banesto: A3 to Baa3

■ BBVA: A3 to Baa3

■ Caja: Baa2 to Baa3

■ Banca March: Baa1 to Baa3

■ Navarra Caja Rural: Baa1 to Baa3

■ CaixaBank: A3 to Baa3

■ ICO: A3 to Baa3

■ Bankinter: Baa2 to Ba1

■ Bank Coop: Baa1 to Ba1

■ Banco Popular: A3 to Ba1

■ Bankia: Baa3 to Ba2

■ Bank CEISS: Baa3 to B1

■ Catalonia Banc: Ba1 to B1

■ Novacaixagalicia: Ba1 to B1

Although there are six banks that are saved from the burning of Moody's to the sector (Santander, BBVA, Banesto, Caixabank, Banca March and Education Fund), have not escaped suffering a downgrade. Thus, Santander, the better off everyone and that leaves even above the solvency which gives the debt of Spain, has downgraded two notches to Baa2. BBVA subtracts one more, to Baa3. And there, on the brink of junk bond also remain Caixabank, Banca March and Education Fund. For all, sends a warning: they have a negative outlook.

This is the second time that Moody's downgrades the note to the Spanish banks quickly. Last May, the 17th, announced that collectively lowered the rating of Spanish banks and degraded one to three steps the note of 16 Spanish banks, including Banco Santander, BBVA, Banesto and CaixaBank. Still, the four were in a position conducive to investment, in the category considered almost as remarkable.

Meanwhile, Standard & Poor's left at the end of May to the middle of the Spanish financial system, consisting of 14 entities, junk bond. Downgraded the credit rating of five Spanish financial institutions, including the nationalized Bankia, Popular and Bankinter, which were below the investment grade.

More recent is the decision to downgrade the bank at Fitch. On June 11 he downgraded two BBVA and Santander degree, and one day after the rest of the block area, in some cases up to three steps.

0 件のコメント:

コメントを投稿