http://elpais.com

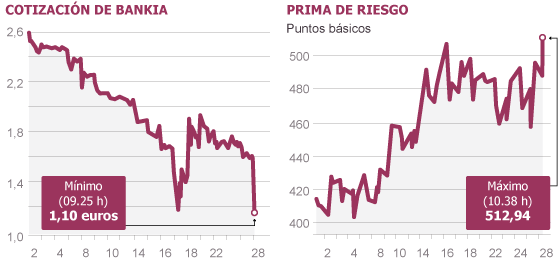

スペインの不良債権問題で国有化されたBANKIA銀行の株価は下落し、1'46ユーロに落下、スペインの10年国債の金利はドイツのに比べ512'94に上昇

Rajoy no logra frenar un lunes negro en los mercados tras el rescate de Bankia

El presidente asegura que “no va a haber ningún rescate de la banca española”

La prima de riesgo supera los 513 puntos básicos por la relación entre deuda y banca

Las acciones de la entidad financiera caen un 13,4% en su regreso al parqué

Los analistas de bancos internacionales creen que los títulos pueden caer a 0,30 euros

Archivado en:

- Bankia

- FROB

- Títulos valores

- Financiación déficit

- Crisis financiera

- Organismos financieros

- Déficit público

- Bolsa

- Servicios bancarios

- España

- Finanzas públicas

- Mercados financieros

- Banca

- Banca

Fuente:Bloomberg / El País

Rajoy can not stop a black market Monday after the rescue of Bankia

The president said that "there will be no rescue of Spanish banks"

The risk premium exceeds 513 basis points by the ratio between debt and banking

Shares of the bank fell by 13.4% in his return to hardwood

International banks analysts believe that the securities may fall to 0.30 euros

Share price of Bankia

Isabel Lafont / Miguel Jimenez Madrid 28 MAY 2012 - 18:04 CET

The president said that "there will be no rescue of Spanish banks"

The risk premium exceeds 513 basis points by the ratio between debt and banking

Shares of the bank fell by 13.4% in his return to hardwood

International banks analysts believe that the securities may fall to 0.30 euros

Share price of Bankia

Isabel Lafont / Miguel Jimenez Madrid 28 MAY 2012 - 18:04 CET

Bankia has returned today to go public with plummeting 26% in its first move after being suspended since Thursday and ended up closing the session with a cut of 13.38%, bringing the bank's shares have fallen to 1 , 36 euros. The rise of the doubts arising from the nationalization of the entity has also taken its toll on Spanish debt, since interest investors demand to gamble their money in the state's role has come up with determination to touch a new high historic 513 basis points. To tackle the climb, the prime minister, Mariano Rajoy, has appeared just after 13.00 on a special press conference. In his speech, the chief executive has returned to Europe to seek a response to ensure debt sustainability and a clear message in defense of the euro and has flatly denied that Spain is going to need a bailout of its banks. "There will be no rescue of Spanish banks," he assured. However, his words have failed to calm nerves and, in the afternoon, the risk premium has been rising and the stock has increased its fall to close at its lowest level in nine years.

Bankia on aid, the president is confident that the State will recover in the future the 19,000 million to be injected in the state and assured that they will not affect the deficit. "When the entity is sound and, being as it is the first financial institution in Spain, be sold and will recover the State's investment," said Rajoy, who has warned that the alternative to the injection of public funds was "bankrupt", something they could not afford.

Send Video

In Stock, shares of Bankia have marked at least first thing in 1.10 euros, representing a fall of 29.9% over Thursday's close, which was the last marked price before going all day Friday with trading suspended. Then, the decline has slowed to levels of 7% past 12.00 (1.46 euros) until Rajoy has intervened when the punishment has been revived. At closing, the titles have been left bank 13.38% while falling throughout the Ibex 35 have taken speed and led to the Spanish Stock Exchange to mark a new low since 2003, which in turn has dragged losses to the rest of Europe despite all morning trading in green. With this new bump, the accumulated punishment from Rato output expands to 46.8%. Since its debut in July 2011 when it was listed at 3.75%, the collapse is 64%.

However, although there is room in the opinion of the experts to follow falling. Analysts of international investment banks have their ratings published today believe that the slump may be over and manage price targets of 0.20 or 0.30 euros per share, such as JP Morgan and Nomura, although the differences between analysts are important. Deutsche Bank placed its rating or price target of $ 0.50 per share, in Espírito Santo and Mediobanca 0.90 euros to 1 euro.

The risk premium, meanwhile, has come to exceed the 513 basis points, its highest ever, after COUNTRY publish on Sunday that the government plans to ransom by injecting Bankia government bonds directly without going through the market , what have echoed funding agencies and major international media. Generalize this strategy to rescue the financial sector could mean 50,000 or 60,000 million more debt.

According to government sources quoted by Reuters, the executive would have already consulted the Central Bank Europeosobre this pathway and the central bank would have given the nod to the decision. However, Rajoy himself has denied that they carried out the consultation and warned that the decision on the procedure to be chosen to inject capital in Bankia "is not taken." In any case, for the president, the rise that has seen the spread between Spanish and German has "absolutely" nothing to do with Bankia decisions and the financial sector. So, to end the rally, has returned to claim a response from Europe to ensure debt sustainability of countries that have done their homework and a strong message of support on the euro and its future.

more informationThe risk premium brand new highs after the rescue of BankiaOpinion: Why Spain is different, J. ESTEFANÍAAgain the specter of European rescueRajoy European rescue discarded to the bench in an appearance before the pressThe group Bankia suffered in 2011 the largest sector losses

Looking to the future and wondered if you are in favor of amending the European Stability Mechanism for banks to come to him without having to recapitalize their states, Rajoy has said that "it is for many people." "I certainly," he added.

Financial and Savings Bank (BFA), Bankia matrix, called last Friday an injection of capital of 19,000 million euros, in addition to the 4.465 million of preferred securities of the entity held by the Fund and Bank Ordinance Restructuring (FROB) to become actions. Furthermore, after the subsidiary submit its results on Friday, today will be the turn of BFA, whose accounts of 2011 may shed the greatest losses in the history of the Spanish financial sector. From the political class, increase the voices of the PP itself expliaciones claiming public about what happened. The latter have been those of the presidents of Extremadura, Jose Antonio Monagas, and Valencia, Albert Fabra.

Bankia and the risk premium destination are doomed to share in the markets. The crisis of the financial institution has shown the pernicious link between bare Spanish banks and sovereign debt: the Spanish financial system can not adjust the inflated value of their loan assets without public capital injections.

According to Jose Carlos Diez, chief economist Intermoney, "the premium is subject to what makes the Spanish banking sector, but should increase." The greatest impact will undoubtedly be felt in the banks, which are falling Monday on the stock block, which has dragged the Spanish index Ibex 35 losses a few minutes into the session. In his opinion, the CNMV should limit new short selling bank securities "until clarification on the future of the audited entities and other external audits unannounced know."

The tension in the risk premium in recent weeks is explained by the fear that a departure from Greece's euro deposits causes a flight of Spanish banks. But also because the state has to take care of most Spanish banks.

In fact, it remains unclear how articulate the capital increase which will inject 12,000 million Bankia needs. If private shareholders of the entity (some 350,000 who control 55% of capital) do not go to the operation, will dilute its stake to less than 10%, depending on what the conditions of operation. But it is conceivable that there will be keen because of the losses incurred: Bankia stock market has lost nearly 70% since it went public in July 2011.

Therefore, the Government has set out to deliver government bonds directly or FROB in exchange for the shares issued by BFA, which would prevent the Treasury having to resort to the market at a time when investors demand to a Spanish sovereign debt performance record since there is the euro. "No doubt that this affects the vicious circle between banking and sovereign risk," says Angel Berges, a partner of International Financial Analysts (IFA). But that is what has made the European Central Bank (ECB) with their last injections of liquidity: giving money to banks to buy government debt. "I fear that, once opened the spigot, we can only keep feeding the beast: BFA-Bankia must have about 40,000 or 50,000 million debt purchased so far, no matter, if so, who has delivered 19,000 additional directly in exchange for issuing shares, "he adds.

In his opinion, there are only two alternatives: that the ECB buy Spanish public debt directly, not through banks, or the European Financial Stability Fund (EFSF) inject equity to banks without having to go through the Treasury.

Bankia on aid, the president is confident that the State will recover in the future the 19,000 million to be injected in the state and assured that they will not affect the deficit. "When the entity is sound and, being as it is the first financial institution in Spain, be sold and will recover the State's investment," said Rajoy, who has warned that the alternative to the injection of public funds was "bankrupt", something they could not afford.

Send Video

In Stock, shares of Bankia have marked at least first thing in 1.10 euros, representing a fall of 29.9% over Thursday's close, which was the last marked price before going all day Friday with trading suspended. Then, the decline has slowed to levels of 7% past 12.00 (1.46 euros) until Rajoy has intervened when the punishment has been revived. At closing, the titles have been left bank 13.38% while falling throughout the Ibex 35 have taken speed and led to the Spanish Stock Exchange to mark a new low since 2003, which in turn has dragged losses to the rest of Europe despite all morning trading in green. With this new bump, the accumulated punishment from Rato output expands to 46.8%. Since its debut in July 2011 when it was listed at 3.75%, the collapse is 64%.

However, although there is room in the opinion of the experts to follow falling. Analysts of international investment banks have their ratings published today believe that the slump may be over and manage price targets of 0.20 or 0.30 euros per share, such as JP Morgan and Nomura, although the differences between analysts are important. Deutsche Bank placed its rating or price target of $ 0.50 per share, in Espírito Santo and Mediobanca 0.90 euros to 1 euro.

The risk premium, meanwhile, has come to exceed the 513 basis points, its highest ever, after COUNTRY publish on Sunday that the government plans to ransom by injecting Bankia government bonds directly without going through the market , what have echoed funding agencies and major international media. Generalize this strategy to rescue the financial sector could mean 50,000 or 60,000 million more debt.

According to government sources quoted by Reuters, the executive would have already consulted the Central Bank Europeosobre this pathway and the central bank would have given the nod to the decision. However, Rajoy himself has denied that they carried out the consultation and warned that the decision on the procedure to be chosen to inject capital in Bankia "is not taken." In any case, for the president, the rise that has seen the spread between Spanish and German has "absolutely" nothing to do with Bankia decisions and the financial sector. So, to end the rally, has returned to claim a response from Europe to ensure debt sustainability of countries that have done their homework and a strong message of support on the euro and its future.

more informationThe risk premium brand new highs after the rescue of BankiaOpinion: Why Spain is different, J. ESTEFANÍAAgain the specter of European rescueRajoy European rescue discarded to the bench in an appearance before the pressThe group Bankia suffered in 2011 the largest sector losses

Looking to the future and wondered if you are in favor of amending the European Stability Mechanism for banks to come to him without having to recapitalize their states, Rajoy has said that "it is for many people." "I certainly," he added.

Financial and Savings Bank (BFA), Bankia matrix, called last Friday an injection of capital of 19,000 million euros, in addition to the 4.465 million of preferred securities of the entity held by the Fund and Bank Ordinance Restructuring (FROB) to become actions. Furthermore, after the subsidiary submit its results on Friday, today will be the turn of BFA, whose accounts of 2011 may shed the greatest losses in the history of the Spanish financial sector. From the political class, increase the voices of the PP itself expliaciones claiming public about what happened. The latter have been those of the presidents of Extremadura, Jose Antonio Monagas, and Valencia, Albert Fabra.

Bankia and the risk premium destination are doomed to share in the markets. The crisis of the financial institution has shown the pernicious link between bare Spanish banks and sovereign debt: the Spanish financial system can not adjust the inflated value of their loan assets without public capital injections.

According to Jose Carlos Diez, chief economist Intermoney, "the premium is subject to what makes the Spanish banking sector, but should increase." The greatest impact will undoubtedly be felt in the banks, which are falling Monday on the stock block, which has dragged the Spanish index Ibex 35 losses a few minutes into the session. In his opinion, the CNMV should limit new short selling bank securities "until clarification on the future of the audited entities and other external audits unannounced know."

The tension in the risk premium in recent weeks is explained by the fear that a departure from Greece's euro deposits causes a flight of Spanish banks. But also because the state has to take care of most Spanish banks.

In fact, it remains unclear how articulate the capital increase which will inject 12,000 million Bankia needs. If private shareholders of the entity (some 350,000 who control 55% of capital) do not go to the operation, will dilute its stake to less than 10%, depending on what the conditions of operation. But it is conceivable that there will be keen because of the losses incurred: Bankia stock market has lost nearly 70% since it went public in July 2011.

Therefore, the Government has set out to deliver government bonds directly or FROB in exchange for the shares issued by BFA, which would prevent the Treasury having to resort to the market at a time when investors demand to a Spanish sovereign debt performance record since there is the euro. "No doubt that this affects the vicious circle between banking and sovereign risk," says Angel Berges, a partner of International Financial Analysts (IFA). But that is what has made the European Central Bank (ECB) with their last injections of liquidity: giving money to banks to buy government debt. "I fear that, once opened the spigot, we can only keep feeding the beast: BFA-Bankia must have about 40,000 or 50,000 million debt purchased so far, no matter, if so, who has delivered 19,000 additional directly in exchange for issuing shares, "he adds.

In his opinion, there are only two alternatives: that the ECB buy Spanish public debt directly, not through banks, or the European Financial Stability Fund (EFSF) inject equity to banks without having to go through the Treasury.

スペインの不良債権問題で国有化されたBANKIA銀行の株価は下落し、1'46ユーロに落下、スペインの10年国債の金利はドイツのに比べ512'94に上昇

0 件のコメント:

コメントを投稿