http://elpais.com

スペインの不良債権で国有化されたBANKIA銀行の公的資金注入で、スペインの10年国債の金利はドイツのに比べ512'94に上昇し、6'5%に

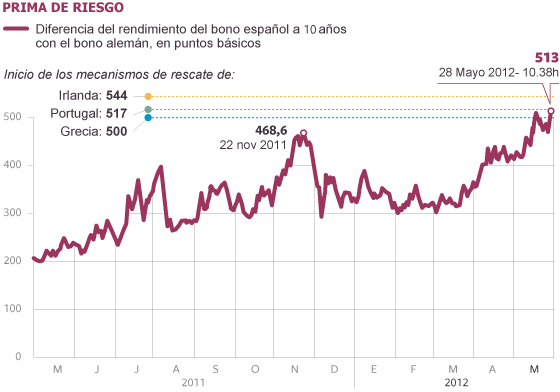

El rescate de Bankia impulsa la prima de riesgo a nuevos máximos

El diferencial entre los bonos españoles y los alemanes rebasa los 513 puntos básicos

La Bolsa cae un 2,12% y marca su nivel más bajo de los últimos nueve años por la banca

Archivado en:

- BFA

- IBEX 35

- Bankia

- Indices bursátiles

- Financiación déficit

- Crisis financiera

- Déficit público

- Bolsa

- España

- Empresas

- Finanzas públicas

- Mercados financieros

- Economía

- Finanzas

- Finanzas

Fuente:Bloomberg / El País

The rescue of Bankia drives the risk premium to new highs

The spread between German and Spanish bonds exceeds the 513 basis points

The stock fell 2.12% and its lowest mark of the last nine years by the banking

Alvaro Romero Madrid 28 MAY 2012 - 18:18 CET

The spread between German and Spanish bonds exceeds the 513 basis points

The stock fell 2.12% and its lowest mark of the last nine years by the banking

Alvaro Romero Madrid 28 MAY 2012 - 18:18 CET

The billionaire bailout money Bankia with the State and the Government's attempt to inject the needed funds through debt entity have revived the uncertainty on the overall Spanish public finances, which has increased the output of inverters Spanish debt. Given the greater uncertainty, the risk premium of Spain, which is the premium required of Spanish bonds compared to German reference for its stability, has soared and exceeded for the first time since the creation of the euro to 513 basis points . In the stock, the rescue has not been well received, because the bump that has undergone strong Bankia has dragged the whole Spanish financial sector and, by extension, all the Ibex 35, who has finished marking a new low in recent nine years.

To tackle the climb, the prime minister, Mariano Rajoy, has appeared before the media and has come to ask for a response from Europe to ensure the sustainability of debt and a message of strict defense of the euro. It has also strongly denied that Spain is going to need a bailout of its banking and has ensured that the increased pressure against Spain has nothing to do with Bankia, which is not understood just from outside the country. "There will be no rescue of Spanish banks," said the chief executive the extraordinary press conference has been offered from the headquarters of his party, the PP.

Following the intervention of Rajoy, in which the president also rejected the government has taken a decision on how they will proceed to inject Bankia the 19,000 million it needs the state, the rise of the premium has again accelerated . Again, the stock has been perceived as the president's words.

Light on the Spanish stock market risk premia with the countries of the euro. / SAMUEL SANCHEZ

The crisis of the fourth Spanish bank has shown the pernicious link between bare Spanish banks and sovereign debt: the financial system can not adjust the inflated value of their loan assets without public capital injections, which in turn complicates State's ability to overcome its budget problems.

To overcome the concerns of investors about the financial system, the Government has launched an external audit process, while at the finances of the State is committed to reducing the public deficit to 5.3% of GDP at end year with hard cuts and implementing reforms. However, as Bloomberg said this morning in his summary of market conditions, the beneficial effect may have had the announcement of bank analysis is weakened by the rescue of Bankia and BFA. Some also goes further. "Events in Bankia reinforce the view that the next independent audit should emerge significant recapitalization requirements in the Spanish banking system," according to Nomura points in a note sent to clients, which calculates the whole system needs between 50,000 and 60,000 million.

Thus, if Bankia problems extend to other entities, the option would be left for Spain to recapitalize the sector is reminiscent analysts resort to the European bailout funds. The Bank Restructuring Fund (FROB), reinforced to carry the bill has run dry Bankia the first exchange.

It does not help build confidence pathway is emerging as chosen by the Executive to implement the assistance requested by the financial institution, the fourth largest to be held by direct injection of public debt in the group. This option, while avoiding having to go to the market to attract liquidity, raise the national debt and, according to analysts, may cause apprehension among investors, penalizing outstanding debt and ultimately hinder the financing of the Treasury. The measure has already been used in Germany and Ireland.

more informationBankia falls to 30% on the Stock Exchange after the government bailout planThe Government dodge the debt markets by injecting in BankiaThe Government believes that the ECB does not preclude the injection of bank bondsAgain the specter of European rescue

As reported by the Government to Reuters, the measure has been consulted on the ECB, which has given its approval to the recapitalization of Bankia with debt. Rajoy has declined while the consultation stressed that no decision taken on how to carry out the injection of capital.

Given this scenario of uncertainty, the spread between Spanish and German, considered the best indicator of a state trust and amounts to a toll for all banks and companies in the country when setting out to seek funding, there was never passed until Monday the 513 basis points more than 19 data points over the end of Friday. So far, the harassment against Spain in the markets had resulted in the intraday high of 507 basis points on May 16.

The premium has reached maximum after rising to 6.5% of the required return to the Spanish 10-year bonds on the secondary market, where are exchanged Treasury securities once issued. At the same time, operators have settled for a meager 1.36% interest to buy German bonds, which have been greatly benefited over the crisis by their status as a safe haven and are listed on the lowest level in the 13 years of the euro.

"A 6 or more than 6% is the interest rate debt to ten years for a country with the potential for growth, diversiicación and size of the Spanish economy, but we must regain the trust (the market), "Efe has recognized the Spanish member of the executive committee of the ECB Jose Manuel Gonzalez-Paramo, whose term expires on May 31. However, dismisses that are "speculators who are behind all this." "I think it's more a matter of timing," he added.

As for the other countries under pressure, comparison with Italy has deteriorated further analysis at the expense of Spain, since the distance between the two partners of the euro in terms of risk premium expands. Thus, while the Spanish spread has increased by nearly 20 points, the Italian has done in six, to 436, resulting in a space of 77 points. Since Spain beat Italy and placed as the next country most likely to need help from its European partners in March, in the opinion of the market, had not been so separated.

In the Stock Exchanges, the setback to Bankia, which has come to losing a third of its value in his return to the stock and the figures of the recovery plan and new accounts listed on the table, has dragged the whole financial sector . The correction has led to banks subject to turn to all the Spanish index, the Ibex 35, as the morning progressed increased its fall and lost the improvement of other European reference places you have lived by morning. At closing, the Spanish stock exchange has been left open 2.12% and in 6401 points tomorrow, which is destroying the previous minimum throughout the crisis and return to 2003 levels.

For names, Bankia has led the declines with a reduction of 13.38% followed by the People or Sacyr, as both values have also left more than 7%. The other banks were left between 5.34% (Sabadell) to 3.32% (Santander). Telefónica, which has now given way first company by market capitalization to Inditex, has left a 1.86%.

On Monday, investors have no reference of Wall Street, as the U.S. market is closed for a holiday, which provided that the point of anteción investors were Bankia and Spain. Bad topic of conversation since the end of the session all the European stock markets have ended the day in red with the exception of London and its meager increase of 0.08%. At the close, Frankfurt has been left by 0.26%, Milan and Paris 0.76% 0.16%.

Faced with the uncertainty embodied in the figure of Spain and Bankia, from Greece, another flashpoint of the crisis, on Monday have reached some positive news that have sustained increases in the first half of the day. The rise of the Greek New Democracy party in the election polls has encouraged shopping parks outside of Spain as this formation is favored to go ahead with the cuts imposed by Brussels, the ECB and the IMF, which point away from the fear of a breakdown of the euro.

Lower tensions over Greece have also eased pressure on the European currency, which has come to exceed 1.26 in the morning the euro momentarily. Following this peak, has moderated his recovery to stabilize their exchange about 1.258 units of the greenback.

To tackle the climb, the prime minister, Mariano Rajoy, has appeared before the media and has come to ask for a response from Europe to ensure the sustainability of debt and a message of strict defense of the euro. It has also strongly denied that Spain is going to need a bailout of its banking and has ensured that the increased pressure against Spain has nothing to do with Bankia, which is not understood just from outside the country. "There will be no rescue of Spanish banks," said the chief executive the extraordinary press conference has been offered from the headquarters of his party, the PP.

Following the intervention of Rajoy, in which the president also rejected the government has taken a decision on how they will proceed to inject Bankia the 19,000 million it needs the state, the rise of the premium has again accelerated . Again, the stock has been perceived as the president's words.

Light on the Spanish stock market risk premia with the countries of the euro. / SAMUEL SANCHEZ

The crisis of the fourth Spanish bank has shown the pernicious link between bare Spanish banks and sovereign debt: the financial system can not adjust the inflated value of their loan assets without public capital injections, which in turn complicates State's ability to overcome its budget problems.

To overcome the concerns of investors about the financial system, the Government has launched an external audit process, while at the finances of the State is committed to reducing the public deficit to 5.3% of GDP at end year with hard cuts and implementing reforms. However, as Bloomberg said this morning in his summary of market conditions, the beneficial effect may have had the announcement of bank analysis is weakened by the rescue of Bankia and BFA. Some also goes further. "Events in Bankia reinforce the view that the next independent audit should emerge significant recapitalization requirements in the Spanish banking system," according to Nomura points in a note sent to clients, which calculates the whole system needs between 50,000 and 60,000 million.

Thus, if Bankia problems extend to other entities, the option would be left for Spain to recapitalize the sector is reminiscent analysts resort to the European bailout funds. The Bank Restructuring Fund (FROB), reinforced to carry the bill has run dry Bankia the first exchange.

It does not help build confidence pathway is emerging as chosen by the Executive to implement the assistance requested by the financial institution, the fourth largest to be held by direct injection of public debt in the group. This option, while avoiding having to go to the market to attract liquidity, raise the national debt and, according to analysts, may cause apprehension among investors, penalizing outstanding debt and ultimately hinder the financing of the Treasury. The measure has already been used in Germany and Ireland.

more informationBankia falls to 30% on the Stock Exchange after the government bailout planThe Government dodge the debt markets by injecting in BankiaThe Government believes that the ECB does not preclude the injection of bank bondsAgain the specter of European rescue

As reported by the Government to Reuters, the measure has been consulted on the ECB, which has given its approval to the recapitalization of Bankia with debt. Rajoy has declined while the consultation stressed that no decision taken on how to carry out the injection of capital.

Given this scenario of uncertainty, the spread between Spanish and German, considered the best indicator of a state trust and amounts to a toll for all banks and companies in the country when setting out to seek funding, there was never passed until Monday the 513 basis points more than 19 data points over the end of Friday. So far, the harassment against Spain in the markets had resulted in the intraday high of 507 basis points on May 16.

The premium has reached maximum after rising to 6.5% of the required return to the Spanish 10-year bonds on the secondary market, where are exchanged Treasury securities once issued. At the same time, operators have settled for a meager 1.36% interest to buy German bonds, which have been greatly benefited over the crisis by their status as a safe haven and are listed on the lowest level in the 13 years of the euro.

"A 6 or more than 6% is the interest rate debt to ten years for a country with the potential for growth, diversiicación and size of the Spanish economy, but we must regain the trust (the market), "Efe has recognized the Spanish member of the executive committee of the ECB Jose Manuel Gonzalez-Paramo, whose term expires on May 31. However, dismisses that are "speculators who are behind all this." "I think it's more a matter of timing," he added.

As for the other countries under pressure, comparison with Italy has deteriorated further analysis at the expense of Spain, since the distance between the two partners of the euro in terms of risk premium expands. Thus, while the Spanish spread has increased by nearly 20 points, the Italian has done in six, to 436, resulting in a space of 77 points. Since Spain beat Italy and placed as the next country most likely to need help from its European partners in March, in the opinion of the market, had not been so separated.

In the Stock Exchanges, the setback to Bankia, which has come to losing a third of its value in his return to the stock and the figures of the recovery plan and new accounts listed on the table, has dragged the whole financial sector . The correction has led to banks subject to turn to all the Spanish index, the Ibex 35, as the morning progressed increased its fall and lost the improvement of other European reference places you have lived by morning. At closing, the Spanish stock exchange has been left open 2.12% and in 6401 points tomorrow, which is destroying the previous minimum throughout the crisis and return to 2003 levels.

For names, Bankia has led the declines with a reduction of 13.38% followed by the People or Sacyr, as both values have also left more than 7%. The other banks were left between 5.34% (Sabadell) to 3.32% (Santander). Telefónica, which has now given way first company by market capitalization to Inditex, has left a 1.86%.

On Monday, investors have no reference of Wall Street, as the U.S. market is closed for a holiday, which provided that the point of anteción investors were Bankia and Spain. Bad topic of conversation since the end of the session all the European stock markets have ended the day in red with the exception of London and its meager increase of 0.08%. At the close, Frankfurt has been left by 0.26%, Milan and Paris 0.76% 0.16%.

Faced with the uncertainty embodied in the figure of Spain and Bankia, from Greece, another flashpoint of the crisis, on Monday have reached some positive news that have sustained increases in the first half of the day. The rise of the Greek New Democracy party in the election polls has encouraged shopping parks outside of Spain as this formation is favored to go ahead with the cuts imposed by Brussels, the ECB and the IMF, which point away from the fear of a breakdown of the euro.

Lower tensions over Greece have also eased pressure on the European currency, which has come to exceed 1.26 in the morning the euro momentarily. Following this peak, has moderated his recovery to stabilize their exchange about 1.258 units of the greenback.

スペインの不良債権で国有化されたBANKIA銀行の公的資金注入で、スペインの10年国債の金利はドイツのに比べ512'94に上昇し、6'5%に

0 件のコメント:

コメントを投稿