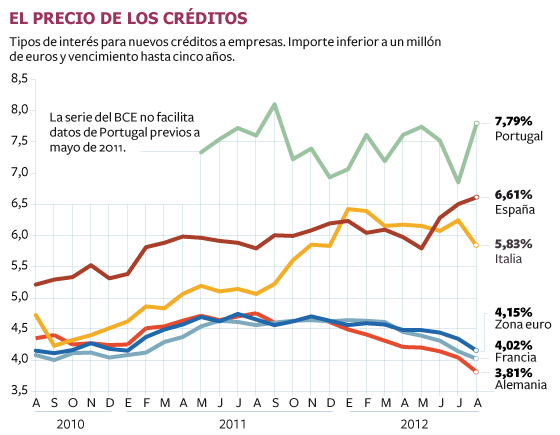

スペインの中小企業が銀行から金を借りる時の金利は6'61%で、ドイツの3'81%の2倍(100万0000ユーロまでで5年満期),

ポルトガルは7'79%、スロベニアは6'9%、キプロスは6'88%、イタリアは5'83%、ユーロ圏平均は4'15%、フランスは4'02%, ドイツは3'81%

Las pymes españolas pagan el doble que las alemanas por un préstamo

Los bancos piden en España un 6,61% por un crédito de hasta un millón de euros y a cinco años, frente al 4,15% de media en la zona euro

Isabel Lafont Madrid 5 OCT 2012 - 00

Spanish SMEs pay double that of Germany by a loan

Banks in Spain asking for a 6.61% credit up to one million euros and five years, compared to 4.15% on average in the euro area

Lafont Isabel Madrid 5 OCT 2012 - 00:00 CET

The sovereign debt crisis and the low resistance of the risk premium is gorging on small and medium enterprises. According to figures released yesterday by the European Central Bank (ECB), the cost of a bank loan of up to one million euros with a maturity of one to five years, which usually tend to ask SMEs, increased again in August in Spain , to stand at 6.61% (6.5% in July). No interest is paid about as high since October 2008, in the turmoil following the collapse of Lehman Brothers.

It is the largest cost of the bank financing in the euro zone after Portugal (7.79%), Slovenia (6.9%) and Cyprus (6.88%). The first country has been rescued, the third party has requested and is growing speculation that Slovenia could be next.

The competitive disadvantage of Spanish SMEs obvious if one considers that, for the same loan, a German company would have to pay an interest rate of 3.81% (4.04% in July), almost half, and in France the cost stood at 4.02% in August (4.14% the previous month). Even Italy, which rose to 6.24% in July, eased to 5.83% in August. The euro area average was 4.15%.

About 70% of business finance bank in Spain

The disparity reflects a fragmentation of the euro zone in fact, that yesterday the President of European Central Bank (ECB) recognized as "unacceptable": "Certainly, when two subsidiaries of the same company located in two different countries are paying interest rates completely different for loans, when exactly the same borrower, say a young couple who want to buy an apartment, pay an interest rate on a mortgage completely different, then one begins to wonder if perhaps there is a problem here, "said the press conference after the meeting in which the Governing Council of the institution left the official cash rate at 0.75%.

Crunch and high interest loans

This fragmentation is maintained even though the risk premium, the yield spread between 10-year Spanish bond and its German counterpart, has eased from a record high. On July 24, closed at 638 basis points yesterday and ended in 445, a level that still maintains bond yields to 10 years in the vicinity of 6%. At two years, investors demand a 3.277%. Public debt is the underlying benchmark for companies to finance, so the impact is immediate.

Draghi said yesterday that it is "unacceptable" the fragmentation of the Eurozone

The high cost of bank loans is particularly severe in Spain, where about 70% of corporate finance is that origin. According to Citi strategist for Spain, José Luis Martínez, to normalize the market should be several elements: "If sovereign risk is stabilized, eliminating the uncertainty on the financial sector and restore the funding for banks will be provided the flow of credit. " Martinez recalls the perverse link between all this: between 7% and 8% of the assets of the Spanish financial institutions are public debt, especially Spanish.

Juan Luis Garcia Alejo, Inversis Management director, said that the whole financial market as a whole is malfunctioning and that is driving companies access to banks: "Seven years ago, although a provider paid more than 200 days, companies could be financed at 1% and endured. Now, if a company gets a contract with the government and pay him to 500 days, no business. "

0 件のコメント:

コメントを投稿