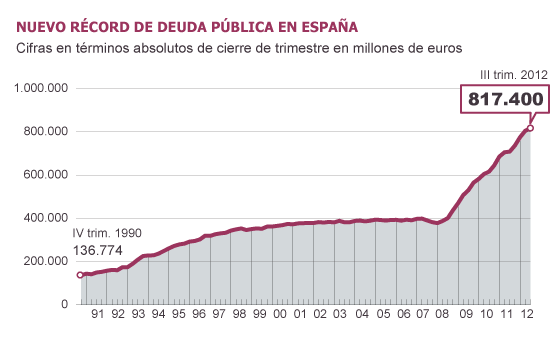

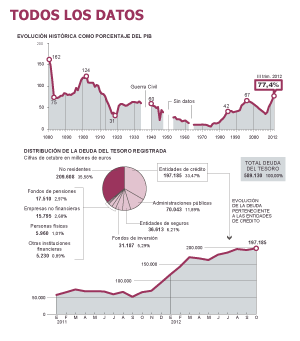

スペインの2012年7月ー9月の公的(政府·自治州政府·市町村自治体)の債務は至上最高の8174億0000'0000ユーロに、国内総生産(gdp)の77'4%に、国内総生産(gdp)は1兆0550億0000'0000ユーロ。2012年1月ー3月は13%増加、2012年4月ー6月は14%増加、2012年7月ー9月は15'4%増加、不良債権で破綻して国有化された銀行の救援融資の370億0000'0000ユーロが影響、2012年の公的債務は1兆0000'0000'0000ユーロに達するよう、

El rescate a la banca ya castiga a la deuda

El endeudamiento de las Administraciones aumenta hasta 817.400 millones en el tercer trimestre, un récord absoluto y el máximo desde 1912 en relación con el PIB

La mayor parte del rescate se perderá

Miguel Jiménez Madrid 2 DIC 2012 - 00:59 CET

Fuente: Banco de España, FMI y Dirección General del Tesoro y Política Financiera. / EL PAíS

disponibles de deuda pública de los países miembros de la institución.

ampliar foto

ampliar foto

EL PAíS

The banking bailout and debt punishes

The general government debt increased to 817,400 million in the third quarter, and the maximum absolute record since 1912 in relation to GDP

Most of the bailout will be lost

Miguel Jimenez Madrid 2 DIC 2012 - 00:59 CET

Spanish public debt continues to break records and becomes an increasingly heavy burden for economic recovery. In the third quarter of this year exceeded 817,400 million euros, according to Bank of Spain. That figure is high in absolute terms and the highest level relative to gross domestic product (GDP) for exactly a century. In September the figure has begun despite the rescue of banks and in particular the Bankia group, to which the State injected 4,500 million in September before receiving European aid to recapitalize the sector. In the fourth quarter, the debt situation will worsen with the European bailout.

Public debt hits record, not only, but also accelerates its growth rate. As the economy falls, the public debt increased by 15.4% in a year, compared with 14% year growing in the second quarter and 13% from the first. The Bank of Spain has not officially published data for the third quarter debt with detailed breakdown by administrations (central, autonomous regions and municipalities) until next week, but the aggregate data that already works show that acceleration.

The debt grows from June to September in almost 13,000 million euros

The third quarter is usually one of the most favorable to the government accounts. This year, however, the increase in public debt from June to September was almost 13,000 million euros, more than four times that in 2011. This total public debt stood at 817,400 million. That equates to 77.4% of GDP reference to the national accounts data for the last four quarters, with a combined GDP of 1,055 billion euros, according to the National Statistics Institute. The Bank of Spain will release its own calculation on 14 December. In relation to GDP, the debt figure reached in the third quarter is the highest since 1912, when it stood at 82%, according to the database published by the International Monetary Fund, which has collected the historical data available public debt of member countries of the institution.

THE COUNTRY

The situation is bound to worsen with the bailout. The debt closed 2012 with an increase well above the 100,000 million in the full year, an increase of over 2010 or 2011. In central government, increased debt this year is on track to make a record, even higher than 2009, the black year of Spanish public finances.

The fatter debt this quarter with the release of the 37,000 million needed to recapitalize the group Bankia, Catalunya Banc, NCG Banco and Banco de Valencia over the amount allocated to the bad bank, dubbed Sareb. The European bailout fund will transfer the redemption amount to the Fund for Orderly Bank Restructuring (FROB) that will be that, in turn, to recapitalize banks.

Liabilities will grow even faster with the release of European rescue

Furthermore, the result also Sareb firing the volume of debt private theoretically but-guaranteed. The International Monetary Fund has warned the extra risk it poses to public accounts.

That debt also will turn into deficit mostly go as revealing it generates losses rescue. In Banco de Valencia already lost 4,500 million more European funds previously injected 1,000 million since the company was sold for one euro. Also be very difficult to recover the money injected into Catalunya Banc, NCG and BFA-Bankia Bank.

The advantage is that the European bailout will have a low cost debt, the economy minister, Luis de Guindos, has been estimated at 1%. The downgrade of the European bailout funds can contribute to something that cost expensive. The worst thing is that the increase in the volume of debt by bailing out banks and the need to resort to European aid have punished the cost of Spanish debt issue as a whole. Although the ratio of government debt to GDP is lower in Spain than the European average, favorable to Spain this differential is narrowing rapidly.

Delays in union bank, on which now again try ministers of Economy and Finance of the Eurozone, and Germany's refusal to allow the European rescue fund to recapitalize banks directly preventing the vicious circle of debt sovereign debt. They doubt the solvency of the country for the liabilities it has faced in the financial sector and doubt the solvency of the bank for the amount of Spanish public debt has in his gut.

Treasury securities held by the bank marked record in October

The latest statistics from the Directorate General of the Treasury and Financial Policy, recently published, show that the volume of public debt portfolio held Treasury registered bank in October marked a record high of 197.185 million euros. With this, banks hoard back to more than a third of total Treasury debt. The registered portfolio, ie the portfolio to maturity adjusted transactions and simultaneous, has nearly quadrupled in one year. The link between public sector and financial sector has increased.

Meanwhile, foreign investors, who in September increased their holdings of debt on more than 18,000 million to 210.238 million, the heat of the ECB's plan to buy bonds of countries requesting the bailout, have further reduced their portfolio in October. They have done very little, at only 630 million. In fact, its relative share has increased to 35.58% of the total, which is a hit in a month maturities were strong, largely subscribed by foreign investors. Purchases on new auctions and in the secondary market have offset almost all those deadlines, and have enabled the Treasury to maintain good liquidity cushion to close the year with calm.

0 件のコメント:

コメントを投稿