スペインの年金制度改革案は、年金の物価上昇指数の連動の自動的値上げに分れを告げて、社会保険収入や年金制度支出、年金受給者数、平均年金額等のFactor de Revalorizacion Anual,Factor de Equidad Intergeneracionalを考慮に射れる

El FRA, la fórmula para sustituir al IPC en la revisión de las pensiones

Las prestaciones subirán menos cuanto más crezca el número de pensionistas

Ingresos y gastos de la Seguridad Social y la pensión media entran en la ecuación

Miguel Jiménez Madrid 7 JUN 2013 - 10:38 CET

The FRA, the formula to replace the IPC in the review of pensions

The benefits rise less grow the more the number of pensioners

Income and Social Security costs and the average pension come into the equation

Miguel Jiménez Madrid 7 JUN 2013 - 10:38 CET

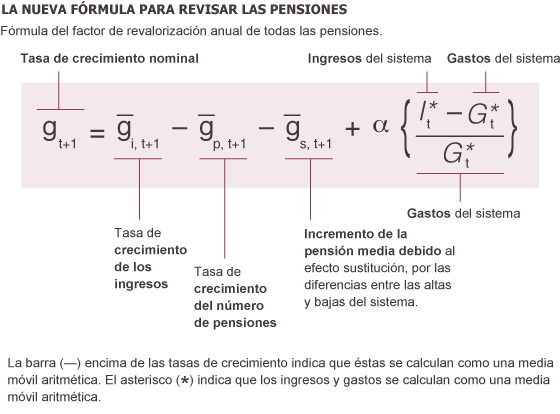

Farewell to the IPC. The formula by which pensions went up every year based on the increase in prices will happen to a better life. The new formula proposed by the experts is the FRA Annual Revaluation Factor, that although it is called so not only will lower pension increase, but even leaves the door open for nominal downs. In the equation, the CPI ceases to matter (except indirectly) and what matters are the income and expenses of the pension system, the number of pensioners and the evolution of the average pension. The FRA will apply while EIF formula or Intergenerational Equity Factor, which cause reductions in the initial pension is accessed retirement depending on how much increase life expectancy.

After unveiling the formula COUNTRY had proposed in the first draft, experts have refined the equation a bit and have made efforts to simplify the presentation of some formula, but remain essentially the same elements. Yes, have been removed from the final version of its report that that for the sustainability factor and expect effective social support, "it is necessary that the formulas are easily understood," which obviously had not been achieved.

Now, try to present the formula in a more accessible. The nominal growth rate of pension is calculated as the growth rate of income (which may be positive or negative) minus the growth rate in the number of pension least average pension increased by the substitution effect (for the differences between high and low pensioners) plus the percentage of surplus or deficit of the system in relation to the expenditure multiplied by a coefficient that sets the pace at which you want to correct the fiscal imbalance the system.

More complicated than the CPI, of course. but the thing is not there. The first three parts of the sum are calculated as a moving average of the year concerned arithmetic over the previous five plus five subsequent forecasts. For example, for 2014 the formula would take into account the rate of change in the number of pensioners from 2009-2019 and pampering for the rate of change of the average pension or income. Rates are added all those years and divide by 11: that is the arithmetic mean. And in the last element of the formula I used are geometric moving averages of income and expenses of the system. The geometric mean is calculated by multiplying revenues 2009 revenues by 2010 by 2011 ... and so until 2019. That would give a total of about 121 figures (occupy about two lines of this text, the publisher can show a complete example) you would have to give the root eleventh to achieve the geometric mean. A geometric mean of income you subtract the expenses and the result is divided in turn by the geometric mean of the expenses. All this would be multiplied by a coefficient that measures the speed at which budgetary imbalances are corrected the system.

Suppose that you understand the formula, you can calculate moving averages and geometric, who knows what the pension expenditure, income and expenses and the average pension system. Even so, you can not calculate on their own what the FRA. Depend on government forecasts about future revenues and expenses, of the actuarial calculations on the evolution of the number of pensioners and the effect of replacing pensions (pensioners who die usually have lower pensions for new retirees) and coefficient of the Government choose to go correcting budgetary imbalances.

Albeit with demographic data in hand, with the deficit situation living on Social Security and the weaker prospects for economic recovery, almost all factors play against. The Social Security revenues are falling, the number of pensioners is increasing, the substitution effect is more expensive the average pension and the relationship between income and expenditure is deficit. That is, if you take a single year in the equation, the four sides of the equation would be negative: the result would be a lowering of pensions (although experts recommend a ground clause for existing pensioners and those who are close to retirement). By taking into account 11 or 13 years, is somewhat dimmed. But if you look at the past, the average pension has been rising between 2 and 3 points for the substitution effect, the number of pensions will grow at a rate of between 1.2% and 1.5%, and in arithmetic, according to the report. The Social Security contributions bear with this, falling five years, and the relationship between income and expenditure is deficit for at least three years. Or paint the forecasts are very optimistic ahead or the application of the formula would freeze or minimum pension increases for several years (unless you decide to earmark new revenue from taxes, for example, the system). That's what it means, ultimately, the FRA.

0 件のコメント:

コメントを投稿