スペインの年金改革(年金順次減少)で、年金生活者の年金額はどのくらい下るのだろうか?

¿Cuánto bajará mi pensión inicial?

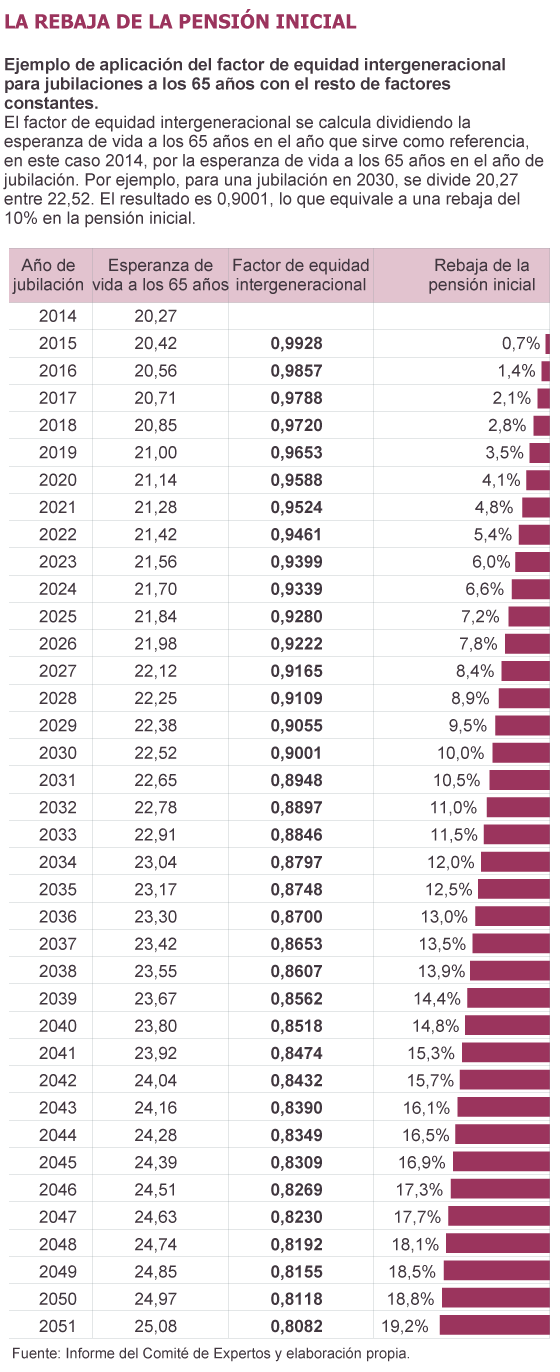

El informe de los expertos cifra hasta en el 19% en 2051 el recorte de la pensión inicial

GRÁFICO Un ejemplo práctico de los cambios en la pensión

Así se calcularán las nuevas pensiones

Miguel Jiménez Madrid 7 JUN 2013 - 00:01 CET

matiza".

How much will lower my initial pension?

The report of the experts in the figure to 19% by 2051 the initial pension cuts

FIGURE A practical example of the changes in the pension

So new pensions will be calculated

Miguel Jiménez Madrid 7 JUN 2013 - 00:01 CET

The final report of the expert committee maintains two key formulas for the implementation of the sustainability factor, named as FEI and FRA. Although technical in nature, both in practice result in lower pensions, especially in times of crisis.

What is the FEI or Intergenerational Equity Factor?

■ Lliga initial pension for new retirees to life expectancy. By definition, does not apply to current pensioners but only to the future. While each year will be reset these factors in light of new life expectancy estimates, the experts included in an annex to the report an example of its application clearly shows how this translates into a reduction of the initial pension.

moreGovernment experts proposed lower pensions in times of crisisThe Government proposes to delay the implementation of the clipping for pactarloPrivate plans to prevent loss against salary pension

■ The EIF will merely applying a discount increasing the initial pension, according to this example. Taking the year 2014, where life expectancy at age 65 is to live 20.27 years longer, the reduction would be 5% for a retiree at age 65 under the same conditions in 2021, as life expectancy for that new pensioners will be 21.28 years. The cut of the initial board isolated EIF application would be 10% in 2030, from 15% in 2040 and 19% in 2050.

■ experts The idea is that, in the future, pensioners receive all along the same benefit retirement regardless of the generation to which they belong. That is, a pensioner who is expected to live 25 years should receive 20% less pension than one who is expected to live 20 years. Obviously, other factors also come into play, making the final calculation is complicated.

Will combine the EIF? Delaying the retirement age?

■ In parallel to the implementation of the EIF, it will produce a delay in the legal retirement age (except for those retirees with longer careers careers) for the progressive implementation of the previous pension reform.■ The report does not explain how the new factor interacts with the delay, which in turn reduces the number of years to receive a pension. At the time, it will gradually implemented, the effect of the previous reform, increasing the years are taken into account by extending the period of computation of pension and the time required to collect a pension, factors in generally also translate into lower pensions.■ The experts, however, cling to the contribution bases have increased and may continue to do so to say that the new formulas are compatible with a higher average pensions. They are, may have higher average pensions, but at the same time much lower than would result from not apply sustainability factor.

What happens if you apply the FRA or Annual Revaluation Factor?

■ It would replace the CPI as a yardstick of the existing pension increase and is linked primarily to revenues and expenses. Its application depends on many parameters to be defined, but also points to lower pensions and loss of purchasing power, especially in times of crisis.

■ In any case, experts insist that although the sustainability factor imposes a number of restrictions to be met annually to ensure a balanced budget and they propose the "most logical parameters" for those formulas, that "sovereignty does not replace popular, and not even erodes or qualifies ".

0 件のコメント:

コメントを投稿