欧州委員会の奨励するスペインの税制改革、スペインの経済の20%は闇経済で、700億0000'0000ユーロの税収の損失!!法人税は控除が多すぎる!

Una reforma fiscal al gusto de Bruselas

Montoro acometerá modificaciones legales en 2014 tras la exigencia europea

La Comisión Europea pide a España eliminar la deducción por planes de pensiones

La mayoría de expertos aboga por reducir deducciones en los grandes impuestos

Jesús Sérvulo González Madrid 1 JUN 2013 - 21:59 CET

normalizando la recaudación, en un escenario económico diferente”, según matizó esta semana.

pulsa en la foto

pulsa en la foto

EL PAÍS

pulsa en la foto

EL PAÍS

A tax reform the taste of Brussels

Montoro undertake legal changes in 2014 after the European demand

The European Commission calls on Spain to eliminate the deduction for pension plans

Most experts advocates reducing the large tax deductions

Jesus Gonzalez Madrid Sérvulo 1 JUN 2013 - 21:59 CET

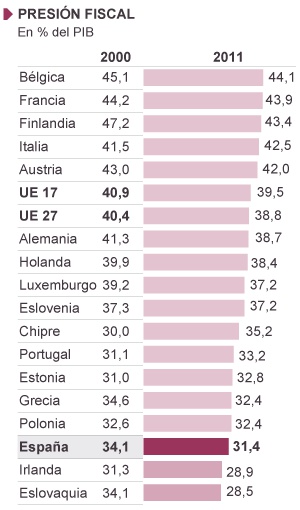

Taxes in Spain are bipolar: despite having higher marginal tax rates is one of the countries with the lowest tax burden, 31.4% of GDP, compared to 39.5% on average in the Euro- . "We have a tax system that produces less than it should," says Ignacio Zubiri, Professor of Applied Economics at the University of the Basque Country. This can only be explained by a high level of fraud, several studies put the economy at around 20% of GDP, about 70,000 million for tax purposes. And an inefficient, studded opening exemptions and tax loopholes to the Treasury.

On Wednesday Brussels called on the Government "a systematic review of the tax system by March 2014." Finance Minister Cristobal Montoro, assume you will have to follow "the guidelines" set by Europe. But it will "from that collection normalizing go in a different economic scenario," according to nuance this week.

COUNTRY

The Spanish economy languishes and the taxable-income, capital and taxable expenditures-have plummeted in recent years. Since the beginning of the crisis, in 2007, the foundation has declined by about 200,000 million, 20% of GDP. In response, the Government has been engaged in major taxes patch. Try to milk the system the most to weather a time of national emergency. In the past year, has approved tax measures thirty-rise in VAT, income tax, deductions suppression companies, among others, to try to fatten the collection. But the system does not stop carburizing.

In recent weeks it has launched a campaign-led by a PP-sector to encourage Rajoy to decrease as the income tax. But Montoro ditch any discussion: "There is no room." Yes, I will reform progresses. This tribute is one of the most complex of the entire system. Follow causing thousands of taxpayers the same nightmares that disturbed the scientist Albert Einstein: "The hardest thing to understand in this world is without doubt the income tax."

The former director of the Institute for Fiscal Studies (IEF) and Professor of Public Finance at the University of Castilla-La Mancha, Juan José Rubio, agrees that "the income tax, as designed, Nothing more". The broad: "The rise has created more distortions that collection." And commitment to eliminate supplementary levy, which raised the maximum rates of 45% to 52% - "as soon as possible." But he warns that "you can not cut taxes without acompasarlos with spending cuts."

Rubio proposes to reform the tax would have to increase the basic allowance for families with fewer resources. Remember that in recent years have barely touched while the CPI upward updated all sections of the tax.

On the number of sections, the marginal rate level and there are different opinions, but all say their model ensures the "progressive"-to pay more income earners. Among these, is the Boga Ramses Perez, president of the Organization of the State Tax Inspectorate, which holds that "we should reduce the excessive weight of the taxation of labor income. It is unacceptable that nearly 90% of income taxes come from employees. It should balance with capital income and professional activities. "

"The rise in income tax collection created more distortion," says an economist

Jose Felix Sanz, professor of applied economics at the Complutense and researcher Savings Foundation defends a tax with two rates, 25% and 35%. "We have to recover the genuine minimum [since 2006 most deductions are applied to the tax liability and the tax base] and eliminate deductions," he says.

Precisely one of the main recommendations of Brussels passes for "consider further fiscal spending limitation on direct taxation." The bureaucratic peculiar language translation is to remove some of the many income tax deductions and societies.

Most tax experts consulted agree that allowances must be reviewed and represent a cost to the state of about 16,400 million. The most substantial is the deduction for home purchase, about 1,800 million a year. But Brussels spotlight is on the deduction on private pension plans.

moreThe Government extends the 2014 payroll tax hike and tax rises SocietiesGuindos conditions the reduction of income tax to Recovery "clear"Raise or lower taxes, BY XAVIER VIDAL-FOLCHIt is not a tax increase is a "new tax"

"On the personal income tax, tax relief on contributions to pension plans has a regressive effect and distorts the composition of savings," says the European Commission. Zubiri is one of the most belligerent at this point: "When we say that there is not enough money for public pension fund is meaningless with public money, with 1.200 million a year, private pension incomes are usually high."

The Commission recommends the Government to "explore the scope for further limiting the application of reduced VAT rates and additional measures regarding environmental taxes, especially taxes on fuel." The EC aims to increase the VAT on transport and leisure sector (which is located in tourism). But the executive refuses to walk this path. Montoro rejects a further rise after VAT increase last September. However, a European court will force the general rate increase (21%) some health products and services notaries and registrars.

Brussels rebalance in favor of taxation towards indirect taxes (levied on consumption such as VAT or special) to lower direct (income tax and societies). Rubio believes that there is scope to raise the VAT return if reduced tax rates on income. Sanz, Func researcher advocates maintaining the current structure of consumption tax. "The problem with this tax," he says, "is the high level of fraud." Therefore, the Commission calls "intensify the fight against the informal economy and undeclared work." Sanz advises: "We have to remove all the special schemes, such as modules or equivalent, which are a hotbed of fraud." All experts agree on this point. The VAT is a tax tremendously inefficient. Collects only 35% of what it should, alert Sanz.

Treasury assumes "the guidelines" of the EU, but "in a different setting"

To satisfy Brussels, Treasury has already announced it will raise some excise taxes. But he insisted that hydrocarbons will not touch. Spain has one of the fuel taxes lower. The problem is that the price of gasoline without tax is the highest in the continent. To compensate, Montoro studies establish other green taxes levied pollution.

In the corporate tax, the Commission technocrats recommend to Spain "additional measures to reduce the bias in favor of debt." Here, the sight of Brussels is aimed at financial expense deduction. The government has already limited Montoro seems unwilling to reduce it more. "The current limitation of 30% works well and is enough," said a few days ago in an interview with Cinco Dias.

The government has advanced a plan to reform this tax. The idea is to shave some of the many deductions that allows large companies decrease their tax bill. "We should definitely remove accelerated depreciation," said Ramses Perez-Boga, who argues that the standard rate (30%) should go down: "It's the highest in Europe and promotes aggressive tax planning". The representative argued that inspectors should clarify the rules on transactions, one of the loopholes used by multinational subsidiaries to transfer income to countries with less taxation.

Zubiri is in favor of the Tax subscribe partnerships with large companies in the Dow: "They would be mechanisms that distinguish stimulus for companies that meet that do not meet". Most experts believe that the main problem with this tax is tax avoidance, which should tighten monitoring on large companies.

The reforms that are lurking in the old corridors of the Ministry of Finance, in the Calle de Alcalá, one thing will not change: the big companies will continue unless citizens paying employees. Is it about the globalized world. If not, ask Apple.

0 件のコメント:

コメントを投稿